Britain tops global millionaire exit list after tax raid

Britain is expected to lose more millionaires than any other country in 2025 amid sweeping tax reforms. Experts debate the real impact as critics question the data behind the so-called exodus.

Britain is expected to lose more millionaires than any other country in 2025 amid sweeping tax reforms. Experts debate the real impact as critics question the data behind the so-called exodus.

Britain could see the largest millionaire outflow in the world this year, with 16,500 high net-worth individuals expected to relocate, according to the Henley Private Wealth Migration Report.

If accurate, this would mark a record departure, with the UK losing more than double the number of millionaires forecast to leave China, and ten times the number projected to exit Russia.

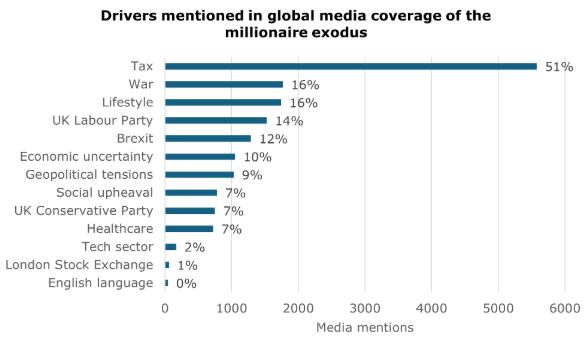

The underlying reason? Tax changes. More precisely, a sweeping overhaul of the UK’s non-domicile (non-dom) regime, alongside reforms to inheritance tax rules, is prompting concern among wealthy residents about their long-term exposure to British taxation.

Henley & Partners, the firm behind the report, claims this “historic wave of wealth migration” could remove £66 billion in investable assets from the country in 2025 alone.

Dr. Juerg Steffen, CEO of Henley & Partners, called 2025 a “pivotal moment,” noting that “for the first time in a decade of tracking, a European country leads the world in millionaire outflows.”

The April abolition of the UK’s non-dom system, which previously allowed wealthy foreigners to shield global income and capital gains from UK tax, has been cited as a major accelerant.

Under the new rules, wealthy foreigners who have lived in Britain for more than four years must now pay full UK taxes on worldwide earnings.

If they stay ten years or more, their global assets also fall under the UK’s 40% inheritance tax net — one of the highest rates in the world.

Steffen said that this shift “triggered a sharp escalation” in exits, “pushing net millionaire departures into double digits for the first time.”

Other countries in Europe — including France, Spain, and Germany — are also expected to see a net loss of millionaires this year. But no country comes close to the UK’s numbers, according to Henley’s forecast.

The United Arab Emirates tops the list of expected beneficiaries, with a projected net gain of 9,800 high-net-worth individuals in 2025. The US, Italy, and Switzerland also rank among the top destinations.

Yet not everyone is convinced the migration is as dramatic as it appears.

A report by the Tax Justice Network, co-published with Patriotic Millionaires UK and Tax Justice UK, calls the Henley report’s conclusions “deeply misleading” and points to major methodological flaws.

According to the review, Henley’s data is based primarily on where millionaires say they work on social media, not where they actually live or pay tax.

Even using Henley’s own definitions, the report notes, the 16,500 projected departures would represent just 0.6% of the UK’s millionaire population — a figure far from what most would describe as an “exodus.”

For comparison, 2024 media coverage referred to a departure of 9,500 millionaires (just 0.3% of UK millionaires) as a “mass migration.”

Alex Cobham, chief executive at the Tax Justice Network, said: “If you took Henley’s numbers seriously, the claim is that just 0.6% of the UK millionaire population will move.

They’re telling us that because the cup might be 0.6% empty — that is, 99.4% full — somehow we should be giving tax breaks to the extremely wealthy.”

Henley itself has shifted its narrative over time. In 2023, the firm dubbed the trend a “Brexodus,” citing political uncertainty.

By October 2024, the term had morphed into “Wexit,” a supposed “wealth exodus” blamed on the then-opposition Labour Party’s rumored tax hikes, even though Labour was not yet in power at the time.

The Labour government has reportedly considered softening its inheritance tax changes in response to growing concerns.

Meanwhile, Nigel Farage’s Reform UK party has proposed a flat £250,000 annual fee allowing wealthy individuals to shield their overseas earnings from UK tax — a move dubbed the “Robin Hood tax.”

Critics argue these reactions may be premature. In the same year media headlines decried a millionaire exodus, official HMRC data showed only a gradual decline in non-dom registrations.

Meanwhile, Knight Frank reported a 14% drop in £5m+ home sales in London, and a £401 million shortfall in stamp duty receipts attributed to changes in the non-dom regime.

Still, the long-term economic impact remains unclear. Professor Trevor Williams, former chief economist at Lloyds Bank Commercial Banking, noted: “Since 2014, the number of resident millionaires in the UK dropped by -9% compared with the W10’s global average growth of +40%.”

In contrast, countries like the US saw millionaire populations jump by 78% over the same period.

The UAE, Malta, and Monaco continue to rise in popularity among wealth migrants due to favorable tax policies and so-called golden visa programs.

Beyond the headlines, CFOs and financial executives are grappling with two critical questions: Is the millionaire flight real? And even if it’s small in volume, is it consequential in value?

While Henley & Partners has faced criticism over transparency and statistical rigor, the underlying concerns about the UK’s long-term competitiveness remain relevant.

Wealth migration may not be widespread, but it is visible — and symbolically powerful.

“The UK had always attracted more millionaires than it lost,” said Steffen. “Now it’s a cautionary tale in this new era of wealth migration.”

But as Stephen Kinsella, a legal consultant and member of Patriotic Millionaires UK, counters: “Millionaires like me aren’t going anywhere. We want to build a better Britain, so we’re proud to pay — and here to stay.”