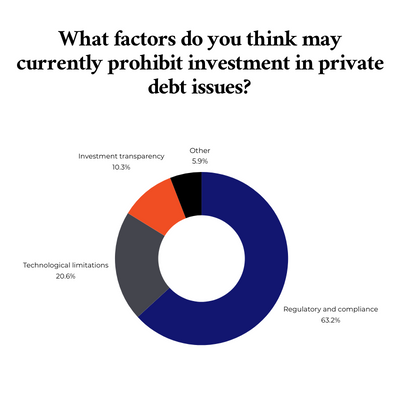

Regulation and compliance issues are the primary barriers to investment in private debt

Key finding of a survey of finance professionals conducted by Tradeteq, the technology provider for securitisation-as-a-service and bank asset distribution

Key finding of a survey of finance professionals conducted by Tradeteq, the technology provider for securitisation-as-a-service and bank asset distribution

Regulatory and compliance issues are the most significant barriers to investment in private debt, according to 63% of respondents to a Tradeteq survey of more than 200 finance professionals from the private debt and trade finance arena.

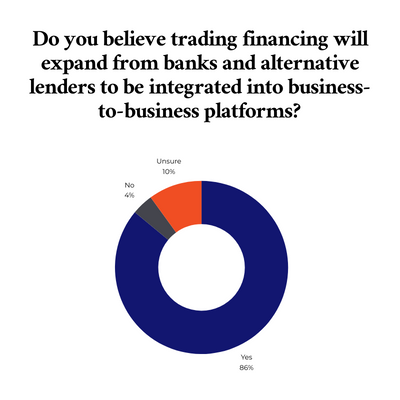

Meanwhile, 86% of trade finance professionals believe that trade financing will expand from banks and alternative lenders into embedded lending.

Both private debt and trade finance assets have witnessed remarkable growth in recent years, as investors shift to alternative assets to create a diversified, stable source of income amid interest rate rises and ongoing volatility.

Both private debt and trade finance assets have witnessed remarkable growth in recent years, as investors shift to alternative assets to create a diversified, stable source of income amid interest rate rises and ongoing volatility.

Total assets under management allocated to private debt are expected to hit $2.3 trillion by the end of 2027, increasing at a faster rate than alternatives overall.

However, US$400bn of the US$1.5tn current size of the private debt industry has still not been deployed.

Similarly, while trade finance has seen global goods exports grow by 26.6% and 11.5% in 2021 and 2022, there remains a trade finance gap of US$2.5tn, a sign of the limited financing available to meet increasing demand.

“These results should serve as a call to transform access to private debt and trade finance investment, at a time where demand for both is growing rapidly,” says Mattia Tomba, Head of International Markets at Tradeteq.

“With any shifts in regulation and compliance likely to take time, Tradeteq’s mission to facilitate transactions between institutional investors and trade finance and private debt originators is a swifter solution to creating liquidity in a traditionally opaque market. This is vital to boost corporate lending, which is one of the key factors that will ensure every great idea is funded and help accelerate economic recovery.”

Tradeteq’s platform converts trade finance and private debt assets into tradeable securities, thereby creating much needed liquidity in both markets. More than US$3 billion worth of notes have been issued under the platform’s securitisation as a service offer, and Tradeteq has serviced over 140 clients, which have collectively financed more than two million instruments through the platform.

Embedded lending means that financing is integrated directly into the trade transaction process and systems, rather than being a separate engagement between the trading partners and a bank or lender.

For example, a supplier could offer financing terms directly to the buyer at the point of transaction, rather than the buyer having to secure financing separately from a bank.

The survey found that 86% of trade finance professionals believe that in the future, trade financing will shift away from being provided solely by banks and alternative lending institutions

. Instead, they believe financing will become embedded into more trade transactions, with the trading partners themselves offering financing as an integrated part of the deal.

This could involve technology platforms that allow suppliers to seamlessly offer credit and financing terms upfront to buyers. It streamlines financing as part of the transaction rather than a separate procedure.