Skill gaps and overstretched teams may hinder many major finance initiatives according to new research from The CFO Alliance.

According to the latest Mid-Market CFO Sentiment Report, top team skills gaps match up with top team and process initiatives. For example, 44% identify workflow automation skills as a top skillset gap; 37% have workflow

automation as a 2024 initiative.

Mid-Market CFOs face the conundrum of bridging the mismatch with existing team design and makeup, balancing investments in upskilling with the burdens of day-to-day workload.

Report findings:

- Mid-Market CFOs are more optimistic about 2024 compared to their Global 2000 counterparts, with a positive outlook on the economy, industry performance, profitability, revenue growth, financing, and talent management.

- Despite this optimism, there’s a noted decrease in CFO Confidence Rating across various categories compared to the previous year.

- Key challenges include excessive workloads, with 35% of CFOs foreseeing double-digit revenue growth and 40% expecting double-digit EBITDA growth.

- Significant concerns remain around revenues, gross margin, operational efficiency, and hiring and retaining employees.

- Major initiatives planned for 2024 include system upgrades or implementations, with a focus on organic growth, technology advancements, and system enhancements as top priorities for profitability improvement.

At the same time, factors like talent gaps, small team sizes, and constant firefighting on daily tasks constrain the ability of these finance teams to train and reskill. This creates a pressing dilemma for CFOs to address if they want their critical target initiatives around modernization, insights, and responsible growth to be viable.

According to the report, 30% of teams are operating with at least 1 person down, while a further 42% expect workloads to get ‘worse’ in 2024.

The high degree of execution risk, driven by skill gaps and resource constraints, reinforces that CFOs must excel as team leaders, resource directors, and energy allocators to deliver on targets and initiatives in 2024.

The complexity is compounded by current team construction and the increasing number of functions rolling up through the CFO. As the finance function and CFO role continue to evolve, leaders will need to be more strategic than ever in selecting the right people and areas for upskilling, tapping into outside expertise, and managing the demands on finance and accounting team members’ time.

The skills under the microscope

Finance and accounting teams are at a pivotal moment of transformation. Mid- Market CFOs recognize that over the next decade, automation, AI, cloud technology, blockchain integration, data analytics, ethical considerations, regulatory changes, cybersecurity, and globalization will redefine their role and alter the skills and makeup of their accounting and finance teams.

Technology advancements are a major focus in finance in 2024. 39% of CFOs anticipate a major system change /update, accompanied by improvements in data connectivity and the promise of bringing AI-driven efficiencies into their teams and processes.

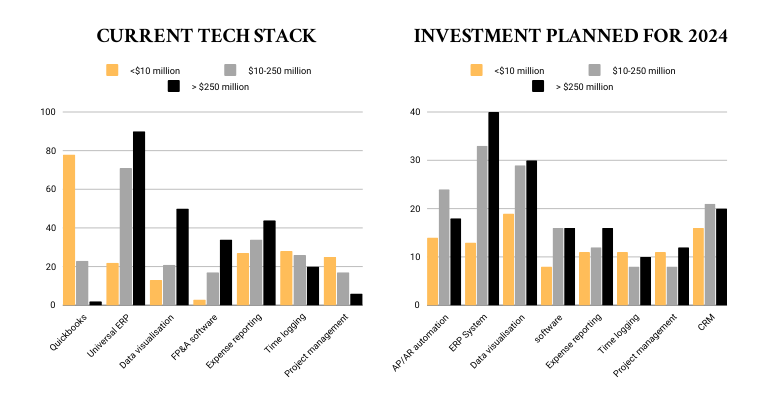

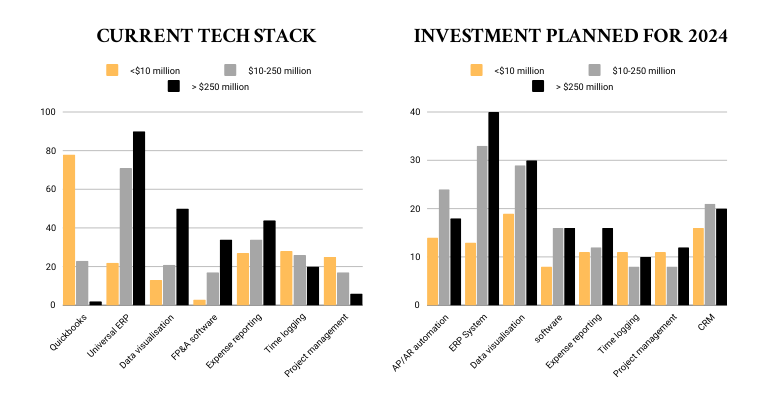

Data Visualization is a top investment area for tech stacks in 2024 (~25% have some capabilities within their current tech stacks and an additional ~30% have planned new data visualization initiatives this year).

Mid-Market CFOs must balance these investments while ensuring that they address their largest current team skill gaps (data synthesis /critical thinking (48%), workflow automation (44%), and technology training /upskilling (38%)).

The report notes there is a blur emerging across technology categories, as ERPs and individual software tools continue to be able to do more from a single hub with enhanced data connectivity across systems.

This will likely favours the largest software and ERP providers, as more controlled data environments help address the data security issues that hinder CFOs’ and organizational adoption of newer technologies (particularly those incorporating AI).

Takeaways

There is a gap between the share of Mid-Market enterprises pursuing new technology initiatives (60%+) vs. the share of finance /accounting teams with planned investments of time /capital into upskilling and training (29%).

This implies substantial execution risk on new technology initiatives, which CFOs can get out in front of by dedicating appropriate time for learning and development for them and their teams. The more the team learns about data architecture and system applications, the better they are able to identify business requirements for technology implementations, saving time and costs (both of which have significant downside risk).

Was this article helpful?

YesNo

Leave a Reply

You must be logged in to post a comment.