Use it or lose it: The importance of embracing technology in finance departments

As we look towards 2024, CFOs are facing an ultimatum: use data differently or risk being left behind.

Of course, finance teams have always had data at their fingertips. But amidst the continued pace of technological change – from automation, analytics and artificial intelligence (AI), to name just a few – we’ve arrived at a ‘use it or lose it’ moment.

Along with this choice comes an opportunity for CFOs – to play a central role in preparing for the new wave of digitalisation, not only for their function but for the organisation as a whole.

With stacks of data and content to analyse, it is important that CFOs harness technology to continue to deliver insight and meaningful analysis. The question is – are they ready?

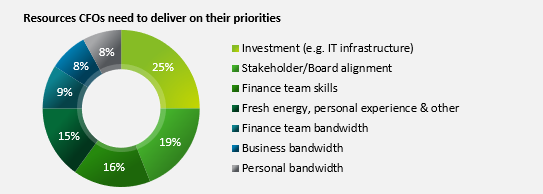

We recently spoke to over 70 CFOs of growing companies about what makes a finance leader effective and it is clear that, whilst CFOs recognise that investment in technology is critical to achieving their priorities, the adoption of technology and development of data analytics skills has been slower than expected, with transformation behind organic business growth and M&A priorities for the majority of CFOs.

The CFOs of today are focused on both business growth and financial health, undertaking expanded roles with responsibilities and influence way beyond core finance. This crucial role needs to be delivered in a rapidly challenging business environment, yet many finance leaders are yet to make the most of the opportunities presented by new technologies.

To maximise the impact and develop the skills of their teams and themselves, CFOs must lead the way in seeking data to support decisions, sharing success stories, and looking for different approaches when there are challenges.

Finance leaders are expected to have a view on all aspects of the business, founded on core finance and the responsibility and credibility that brings. CFOs and their finance teams can collaborate further with their business to bring together datasets, ensure their reliability, tell compelling stories, and be a catalyst for both change and growth. If that was not reason enough to change, there is the fast growing need for reliable reporting on ESG data.

Four years ago, when we last interviewed the group, CFOs were unsure how to realise the opportunities presented by technology and noted a shortage of the right skills in the market, as well as a lack of appetite for investment.

Building the right data capabilities within the finance team is critical, as is building the right data culture within the business, founded on behaviours that regard data as an enterprise asset and embrace the use of data in decision making. For example, one private equity backed company CFO targeted technology investment into revenue growth and built a team more experienced with data to focus on using it to encourage retention of higher spending customers.

Targeted investment is required to create a strong data culture – this could include modernising systems, to recruiting data scientists. Businesses need to see data as an asset worth investing in.

CFOs are focusing both energy and resources on leading and retaining the right skills in their team in times of economic turbulence, but poor data and systems can add fuel to the fire. Finance leaders recognise the need to both engage younger generations and to utilise new systems that can perform the more mundane and repetitive tasks, and enabling this will result in having more time to give to the decisions that need more of a ‘human touch’.

When asked what tools they use to overcome business challenges, CFOs cited ‘teamwork’, ‘relationships’ and ‘communication’ as key enablers. But, CFOs rarely, if ever, mention technology or data to overcome business challenges which could pose an issue in a world where technology is evolving constantly.

Some CFOs believe that there is an overload of data today, and that it can be a struggle to prioritise the right types to be analysed – but implementing new technologies could be a way to mitigate these challenges.

For example, a global telecommunications business that faced significant challenges in using a labour-intensive manual costing process implemented new technology, with integrated AI, to automate the task, which greatly accelerated its decision-making process.

Using data effectively will be key in facilitating top-line growth. If finance leaders can turbocharge their team’s data analytic skills, they will maintain their ‘edge’, taking a lead in showing the business how to achieve growth ambitions, and inspire their people.

To obtain a more holistic view, CFOs need to think through:

To succeed in years to come, finance needs to embrace technology and show the value they can bring whilst remembering that it’s not just the data – it’s what you do with it.