Gaining agility in strategic, financial and operational planning

Current economic conditions are a stark reminder that organisations must be ready to respond to new market opportunities and threats more quickly than ever before. And while the increasing pace of change is putting more pressure on finance teams, many are taking steps to increase agility and improve decision making. How? By innovating beyond static budgeting cycles and focusing on the detailed business drivers and operational plans that directly impact financial performance.

Sophisticated organisations don’t just set financial targets; they also continually monitor performance and develop processes to dynamically update operational assumptions required for integrated business planning (IBP).

Unfortunately, only 23 percent of finance teams have systems that allow their organisation to respond quickly to market changes. Why? Because many organisations still rely on fragmented spreadsheets and legacy corporate performance (CPM) applications to manage their budgeting, planning, forecasting and analysis processes. They spend more time on low-value tasks rather than collaborating with and providing insights to their business partners for key decision-making.

Aligning business plans

Forward-thinking FP&A professionals are pushing the boundaries of budgeting, planning and forecasting across every aspect of the organisation. Strategic FP&A groups require the scale to see holistically across the organisation but also require the flexibility and agility to investigate and drill down deep into detailed operational data. And, importantly, these FP&A teams no longer settle for legacy CPM tools and manual processes that once held them back. And they are more likely to invest in CPM platforms that offer the scale to develop financial plans at the global enterprise level, but also provide the lines of business with the agility to plan at the level of detail they run their business—all within the same unified solution and experience.

Strategic planning & modeling

A modern, unified Intelligent Finance Platform (see Figure 2) is ideal to help organisations manage the strategic planning process. With all financial and detailed operational plans living in a single platform, corporate finance and line of business teams can easily analyse information and develop alternative value creation scenarios on the fly.

Corporate FP&A teams can develop baseline plans for organic growth strategies, M&A initiatives and capital plans while dynamically calculating the impact to P&L, Balance Sheet and Cash Flow plans. Quickly create what-if scenarios to analyse the sensitivity of your cost structure, revenues or capital structure to external drivers such as commodity prices and evaluate FX and interest rate exposure.

Financial budgeting and forecasting

Rigid plans and budgets aren’t very useful anymore. Change is constant and organisations require agile planning processes to continually monitor performance and recast operational plans.

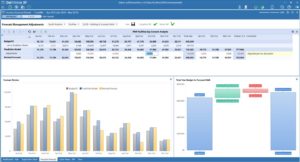

A modern, Intelligent Finance Platform can support top-down, bottom-up, driver-based planning, rolling forecast, predictive analytics (See Figure 3) and other advanced planning techniques. These tools allow finance professionals to collaborate with their business partners to identify opportunities and risks and guide decision making by monitoring the pulse of the company holistically as well as at the business driver level. Sophisticated finance leaders are leveraging driver-based planning to empower business partners to manage their operational plans at the level of granularity they require while also providing visibility into financial results. They can instantly seed budgets and forecasts with powerful predictive models. And with deep operational analytics, Finance organisations are gaining visibility into how sales, production, pricing, insurance or tax changes could affect profitability and future plans.

Integrated business planning

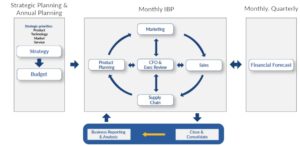

CFOs and finance teams are adopting integrated business planning (IBP) to set organisational strategy and optimise business plans. IBP creates a recurring cycle (See Figure 4) to analyse financial plans and business drivers vs. operational plans, recent run rates and prior year results.

Modern finance leaders are adopting a platform approach to IBP capable of meeting the needs of today while also providing the ability to expand and adapt to changing business demands without adding costs and complexity. Why’s this important?

Because it gives Finance leaders the ability to quickly evolve their detailed operational planning processes such sales planning, people planning, capital planning and cash planning – all while dynamically aligning to P&L, balance sheet and cash-flow plans.

Hyperion Insurance Group is an international firm of insurance brokers and underwriters. With over 4,500 employees worldwide, Hyperion is one of the world’s leading insurance intermediary groups. Since humble beginnings in 1994 as a small London broker, Hyperion has become a leading independent, international insurance group. With four distinct divisions, Hyperion consists of the pre-eminent international retail distribution network outside of North America, a leading independent specialty lines insurance and reinsurance broker, and the only global specialist MGA group. In 2019 Hyperion celebrated its most successful year to date with market-leading organic growth of 11 percent and over £725m in revenue.

Highly acquisitive and geographically dispersed, Hyperion Insurance had a pronounced need for flexibility, controls and standardisation. And with all their growth, Hyperion Insurance outgrew their Anaplan solution, which required ongoing maintenance to connect plans and lacked the financial intelligence required for reporting. These challenges drove the group’s need to replace Anaplan with OneStream’s next-generation platform for financial consolidation, planning, management reporting, employee costing and task management.

“OneStream is a centralised data model where on one side it provides you the control, with the data all in one place, and audit capabilities wrapped around,” said Andy George from Hyperion’s Financial Transformation team. “And on the other side, the users can go in and easily use the dimensionality of OneStream to get down into the detail they need for their reporting.

People Planning, another XF MarketPlace solution, is also being used heavily at Hyperion Insurance. “We load in payroll data and compare the actuals against budget,” said George. “It’s been crucial to have control and data at the right level for our business units.”

Learn more

To learn more about OneStream’s Intelligent Finance Platform for integrated business planning, download a complimentary copy of the 2020 Gartner Magic Quadrant for Cloud FP&A Solutions.