AI-powered spend audit – the secret weapon for finance teams

Anant Kale, CEO and co-founder, AppZen discusses how AppZen’s AI platform has become the finance team’s secret weapon across finance functions

Anant Kale, CEO and co-founder, AppZen discusses how AppZen’s AI platform has become the finance team’s secret weapon across finance functions

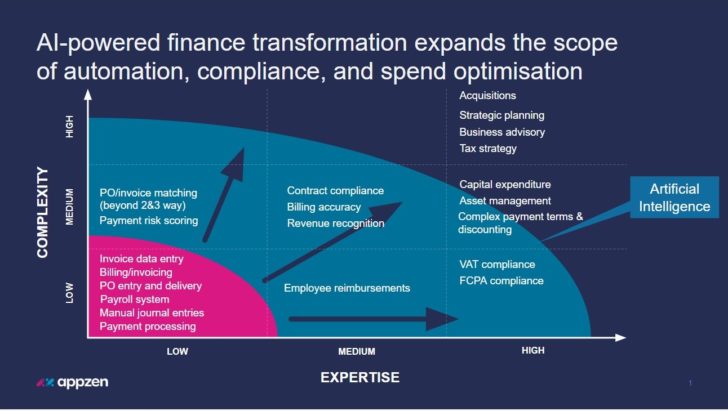

The early years of AppZen have been about developing our vision of an AI platform for modern finance teams. Our aim has always been to help CFOs and their teams make smart decisions and think big, making their visions of finance transformation a reality. The core aim of our platform is to enable the automation of complex manual processes that have historically required deep domain knowledge and human decision making. The platform now offers a huge expansion of scope, allowing an organisation to address more and more operational finance use cases.

We have quickly become the finance team’s secret weapon across finance functions.

This enhanced scope is achieved by introducing AI into workflows where finance is involved, to take on the burden of intensive manual processing. Machines can do this type of processing ten times better than humans, and the capabilities of an AI platform far outstrip both humans and traditional automation. In the current world of finance controls, the focus is on workflow approvals, sampling-based reviews and post-payment audits. Done manually, this constitutes a huge amount of work for the finance team, of which traditional automation can only take on simple, generic processes such as PO entry and delivery, payroll systems, journal and invoice data entry.

Forward-looking organisations working with AppZen’s AI platform can entrust far more complex and demanding processes to automation, such as multi-way invoice/contract matching, tracking complex payment terms and discounting, all payments and reimbursement even with unstructured documents, and VAT and anti-fraud compliance.

In addition, managers can gain insights on spend, highlight high-risk spenders and eliminate rubber stamp manual approvals, so they can understand employee and supplier behaviour over time and make necessary adjustments to process and approvals.

Firstly, we needed to speak the language. So we built the world’s most expansive semantic model for enterprise finance to understand and organise concepts, terms, transactions and data; define and enrich them; and learn how they relate to one another and to other parts of the business.

The natural extension was then to connect financial transactions with other activities in a company. Finance needs wide input to spot anomalies and trends, and this data is captured in documents like contracts, quotes and receipts. We bring it all together by ingesting intelligence from system logs, badge swipes, messages and emails, sensor data, business applications, pricing information, weather signals, financial statistics, merchant databases, regulatory sources and more. Having collated the data we use AI models to make sense of the intelligence they provide, to identify risks, see opportunities and make decisions, all in real-time.

We wanted the platform to be not only vendor-agnostic but as vendor resilient as possible, so we set out to provide robust built-in integrations and interfaces, and the ability to plug into any enterprise application. Our customers can lean forward into AI-powered process transformation without having to wait for expensive, time-consuming application changes or upgrades.

Our taxonomy allows users to classify spend based on their own particular vantage points – procurement, accounts payable, accounting, tax, and executive. This provides the ability to sort spend in a way that’s useful, e.g. to calculate taxes more accurately and efficiently, correct reporting errors before they are finalised, and be more predictive in financial planning and analysis.

It was clear that regulatory compliance is increasingly a concern for all businesses. AI gives organisations a huge leg up in monitoring all of their spend for regulatory violations, and so core features, such as our “lookup list” of politically-exposed persons, foreign officials and healthcare providers, are relevant and useful. Other capabilities like our spend taxonomy and anomaly detection boost the chances an organisation has of detecting regulatory violations and remaining compliant across anti-bribery and corruption, export controls, sanctions, debarments, anti-money laundering and healthcare spend transparency.

An AI platform stands out from a rules-based tool in its ability to learn and hone its models based on user input, resulting in accuracy improvements over time. Our robust predictive model takes into consideration thousands of inputs including employee growth, mergers, seasonality, external factors and corporate idiosyncrasies. In conjunction with simple anomalies such as detecting duplicates, our accuracy improved by an order of magnitude, allowing our customers to gain far more precision without any trade-off.

Put simply, they can detect the most important risky transactions and all of the risky transactions at once.

AppZen prides itself on helping enterprises reduce spend, comply with policy and streamline the process. We aim to rewrite how work gets done in enterprises, improving employee experience, and giving every employee hours back each month. In our next article, we’ll explain more about how we make life just a little bit easier for CFOs and their teams.

By Anant Kale, CEO and co-founder, AppZen