Preparing the ground: how SMEs should tackle Brexit

Small business owners will have to adjust to a different landscape after Brexit, but there are plenty of opportunities argues Brian Harris from foreign exchange broker Currencies Direct

Small business owners will have to adjust to a different landscape after Brexit, but there are plenty of opportunities argues Brian Harris from foreign exchange broker Currencies Direct

Brexit is undoubtedly one of the most significant political events in the UK in the last 50 years. We all know that the issues thrown up by the Brexit process are still being thrashed out by senior officials on either side of the channel. But, even before the UK has officially left the European Union, small business owners are being forced to adjust to a vastly different trading landscape.

Whether you think Brexit is a gift or a disaster, it will require small businesses to fundamentally reassess the way they do business internationally. That means looking beyond the European Union to new international markets to facilitate growth and expansion. The fact remains that SMEs are a critical part of the UK’s economy, accounting for 60% of all private sector employment and 51% of all private sector turnover in the UK. It is vital that these organisations are given the support they need to thrive in the coming years.

Currencies Direct recently conducted a research project in conjunction with Tamebay, a news provider for small businesses that ply their trade through online marketplaces like Amazon and eBay. The survey gathered results from SME owners on the impact of Brexit, the choices they are making regarding global business, barriers they are overcoming and how fluctuations in the value of global currencies are impacting their plans.

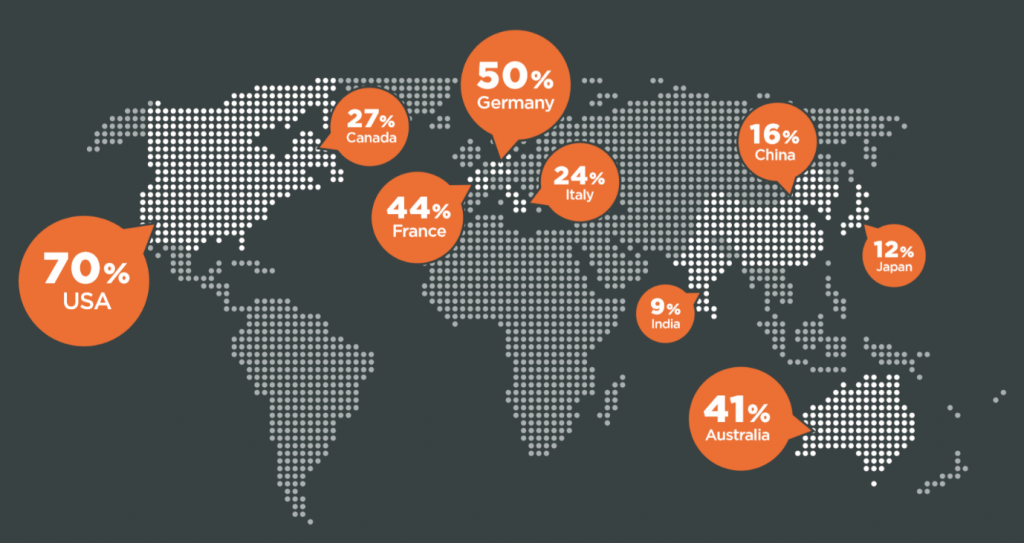

We found that UK SMEs are closely investigating the potential of selling abroad in their plans, with the majority already having a clear idea of key marketplaces to expand into in the coming months. The markets they identified are established, developed and populous, with all having a dedicated Amazon and eBay national site, a useful medium for online retailers seeking to break into new markets. EU countries are still a major target for SMEs expansion plans, with 50% saying Germany was a priority foreign market, 44% saying France and 24% saying Italy.

However, SMEs are increasingly looking beyond the EU for their future growth plans. 70% said that the US was a key priority for expansion, 41% said Australia and 27% said Canada, clearly indicating that large, developed and English-speaking nations lead the way outside of the EU. Beyond that, 16% said China was an opportunity for expansion, 12% said Japan and 9% said India.

In terms of the challenges small businesses face, 47% said logistics of trading internationally was the biggest barrier they faced. Fulfilment, returns and shipping all present potential barriers to breaking into international trade; putting systems in place to meet these obligations (which is often a requirement by law) can quickly eat into profit margins. Cross-border tax issues also present a challenge. Even for trade within the EU under our current system, dealing with each member state’s individual tax system is complex. After Brexit, this area of international trade is not likely to become any easier. Likewise, meeting tax obligations when trading further afield is notoriously complicated and time-consuming. In the USA, for instance, retailers must comply with individual state taxes, as well as federal tax laws.

Language barriers can play a significant role. From crafting marketing collateral to dealing with complaints or placing stock orders, effective communication with clients, customers or suppliers is critical. Even though English is widely spoken around the world, the need to communicate in different languages can dissuade small businesses from getting started with trading internationally.

These barriers are significant but not insurmountable. Specialist international returns companies can ensure that fulfilment processes run smoothly and some third-party services let overseas customers make product returns in their own country, rather than shipping goods directly back to the business. Tax specialists can ensure that your business is tax compliant in overseas territories. And a myriad of translation services – even free online options such as google translate – can go some way to breaking down language barriers and create a dialogue with customers and suppliers alike.

Beyond that, SMEs identify currency fluctuations as a significant impact on their profits. The weakness of the pound globally has raised the comparative cost of imports; even those that source stock from within the UK may face relative price increases due to the cost of raw materials imported from abroad. This, in turn, has allowed exporting businesses to capitalise on the weak pound; one retailer surveyed said that he had since a 300% increase in volumes of overseas purchases since June 2016.

In the next breath, currency fluctuation is one symptom of the uncertainty that has plagued marketplaces since the Brexit vote. Uncertainty is fundamentally bad for business and volatile currencies mean that small businesses have reduced sight over their cash flow and margins can quickly dwindle. 85% of our survey respondents agree that their profit margins are affected by currency market movements. Despite this, only 40% of respondents use a currency exchange specialist to mitigate this risk, with 48% saying they believed they were too small to benefit from such a service, 10% being unaware that such a service existed and 17% believing that a currency specialist would offer no value.

“While the UK’s place in the world remains uncertain, the landscape for small businesses will remain a tricky one. Despite this, SMEs can take action to hedge their currency risk and to protect their working capital.”

SMEs then are broadly aware of the risks posed by volatile currency markets but are unlikely to take steps to mitigate this risk. The reality is that a variety of options are available to small businesses to help in this area; a forward contract, for example, allows a retailer to lock in a set exchange rate for use in future transactions. It’s useful when a business has to make a payment weeks or months after the initial purchase is agreed, as it completely eliminates the risk that the value of a currency could move and ultimately increase a businesses’ costs.

There have undoubtedly been winners and losers since the Brexit vote. But two things have become clear for small businesses: firstly, ongoing uncertainty is not helpful for anyone – be that around the pound’s value, future trading conditions with the EU or the ultimate outcome of the Brexit negotiations. While the UK’s place in the world remains uncertain, the landscape for small businesses will remain a tricky one. Despite this, SMEs can take action to hedge their currency risk and to protect their working capital.

Secondly, our research shows that SMEs are open to and preparing for trade with the rest of the world. Though the EU remains a priority for many, the UK’s small businesses are carrying the standard for global trade after Brexit – one of the many essential steps needed to make post-Brexit Britain succeed on the global stage.

Brian Harris is chief product officer at Currencies Direct