Ben Martin, Managing Director of Brexit Tracker, provides key analysis of current economic data to provide an-in depth view of the Brexit issues financial directors need to be acting on

Many businesses are falling into the trap of believing that Brexit will not have a direct affect on them.

Even if the business or your customers are not directly affected, your customers’ supply chains and sales may be, so it’s prudent to assess all possible pain points.

It’s the indirect impacts that businesses won’t see coming until problems arise.

The media is full of analysis of what might happen post- Brexit. But there are concrete clues already visible in the economic data available to us. Businesses need to be ready to protect against these factors, or stand poised to take advantage as others fail to recognise how the landscape is changing.

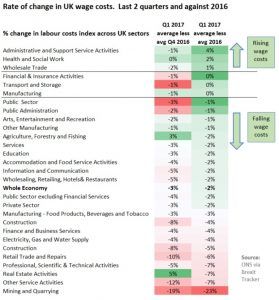

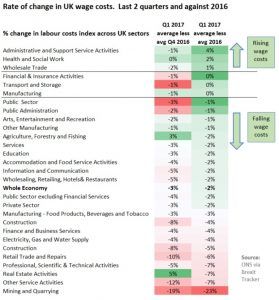

1. Overall wage costs are actually falling – at the moment

The Government’s ambitions of a 100k per annum migration cap and the expected loss of EU freedom of movement post Brexit, both suggest the overall pool of UK workers will decline, which is likely to push up wage demands.

Yet official Office for National Statistics (ONS) data suggests that the overall UK wage index is falling (not adjusted for inflation,) with only three sectors recording a higher wage index in Q1 2017 compared with the average for 2016 (Admin and Support activities, Health & Social work and Wholesale Trade.) The overall wage index fell 2% in this analysis.

Businesses will be tracking their own firm’s wage bill – but what will the impact be on their major customers? They need to start thinking about how they can position their services and price contracts now to take advantage of wage changes within their customer’s sectors.

For example, if a customer is associated with the Admin and Support activities sector, work closely with them now to plan for their future lower profitability, resulting from wage inflation costs. Recognise that they will want to cut their input prices through 2017/2018, so create a pricing structure now that assists them, whilst protecting your revenues, avoiding future issues and creating stronger relationships.

2. There might be less foreign workers – but for now, workers are still coming

Before the Brexit Referendum (Q2 2016) a net 147k of workers from the EU migrated to work in the UK. Despite the Government starting to provide a degree of clarity on EU citizen residency in the UK post Brexit, the overall net number of EU workers arriving has dropped to 112k (Q4 2016) against a backdrop of uncertainty and negative media headlines.

With this in mind, UK employers need to delve into employment data and assess if reduced net inflows of workers are a threat to their business model or an opportunity to stand out as the best employer in their sector.

EU workers arriving in the UK can be categorised as either ‘having a definite job offer’ (60% average in the last three years) or ‘looking for work’ (40%). It’s the latter category that has been hardest hit since the Brexit vote, impacting firms offering seasonal or temporary roles in farming, hospitality and building.

But EU workers who migrate to the UK to a definite job are still coming. So if your business is making offers of employment to workers from say Poland or Estonia, you’ll need to be more effective in attracting these workers. Can you use a local Polish employment agency to market your roles? Are you using LinkedIn to its full potential for overseas, localised searches?

3. Consumer Price Deflation

Consumer price inflation (CPI) in June 2017 was 2.60%, much higher than the average of 0.70% for 2016, but actually lower than May 2017 (2.90%.) High CPI is a worrying economic development, which prompted three Monetary Policy Committee members to vote for a base rate increase in June. But the rate of increase in consumer price inflation isn’t consistent across all industry sectors – with some actually seeing consumer price deflation, with prices the same or lower today than last year.

The Non-alcoholic drinks industry has seen such deflation, with June CPI of -0.30% – though the rate of price reduction is slowing as H2 2016 was -2.9% and H1 2017 was an overall -1%. Its possible price inflation will return to this sector soon.

Businesses will be well aware of price inflation and deflation within their own prices and tariffs, but how connected and knowledgeable are they about they way consumer inflation or deflation impacts their customer base? What are the indirect affects on your operating profits if your major customers are seeing their prices fall? As a business, you won’t be in a position to increase your prices to these customers anytime soon.

If you are selling to a sector which is experiencing higher than average price inflation, it may be feasible to increase your prices. It would be sensible to start conversations with these customers now to assess their views on their changing margins and understand their expectations for any reductions in product volume.

Having this conversation now will not only cement your suppler relations but will allow you to correctly plan your own firm’s pricing and volume of sales.

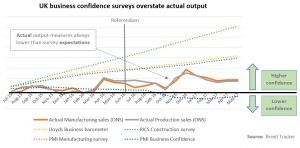

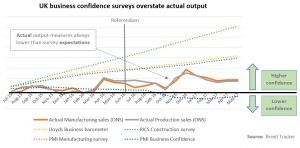

4. UK business confidence levels overshoot actual conditions – so stay close to your customers

Business surveys continue to signal stronger confidence levels than actual business performance. Added to the General Election surprise result and the Brexit referendum itself, all demonstrate how important it is to continually research and listen to your customer base and track whether their views are changing.

While business leaders can be reassured that overall confidence sentiment is high, they need reliable information that tracks how their supplier and customer base view the world.

The results of direct conversation with suppliers and customers should be compared to regional and UK wide surveys to assess the true picture.

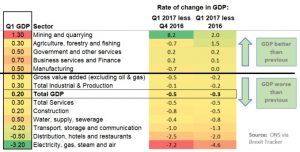

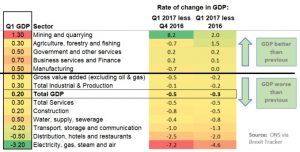

5. UK GDP has fallen, but unevenly

GDP matters to all businesses and provides a crucial measure of the strength of the UK economy. We saw a bounce in GDP of 0.70% post the referendum, but 2017 started poorly with a 0.20% increase.

However, there are huge variations in GDP across industry sectors. If your major customers are within Mining & Quarrying, Business Services & Finance, Manufacturing and Government, then they are benefiting from Q1 2017 GDP printing stronger than the UK average.

These are the customers you need to stay close to, ensuring you have strong supply contracts, and work with to plan higher volume sales through 2017.

However, the same cannot be said for the Distribution, Hotels and Restaurants sector, where quarterly GDP contracted for the first time. Customers here have been used to uninterrupted GDP growth of 1.20% every quarter over the last five years and are likely to be unprepared for negative growth. Their reaction; cost cutting, changes of supply contracts and withdrawal of investment spend.

Summary

Become knowledgeable on the indirect impacts of Brexit at every level through your vertical product production and sales cycle. Uncertainty will remain through 2017 as EU negotiations continue.

UK businesses will continue trading through uncertainty. One of the keys to being successful or minimising the damage is to remain informed and use the wealth of data available to make valuable decisions, boxing clever to stay ahead of your competition.

Finance directors need to educate their boards on what is happening around them, as markets and businesses in their supply chain adapt to Brexit. The early warning signs are already there, so being vigilant and spotting them early is absolutely crucial.

Ben Martin is the founder and Managing Director of Brexit Tracker, a platform that gathers over 390 economic indicators, indices, benchmark rates and Government surveys that have an influence on UK businesses and tracks how they are being impacted by Brexit. He is also regularly featured in the media and in publications such as the Guardian.

Was this article helpful?

YesNo