Organic growth and acquisitions lead CFOs’ investment plans for 2025, survey shows

A new survey from Gartner has revealed that the majority of CFOs are planning to invest heavily in organic growth and acquisitions in 2025, signaling a strategic shift as businesses navigate evolving global economic conditions.

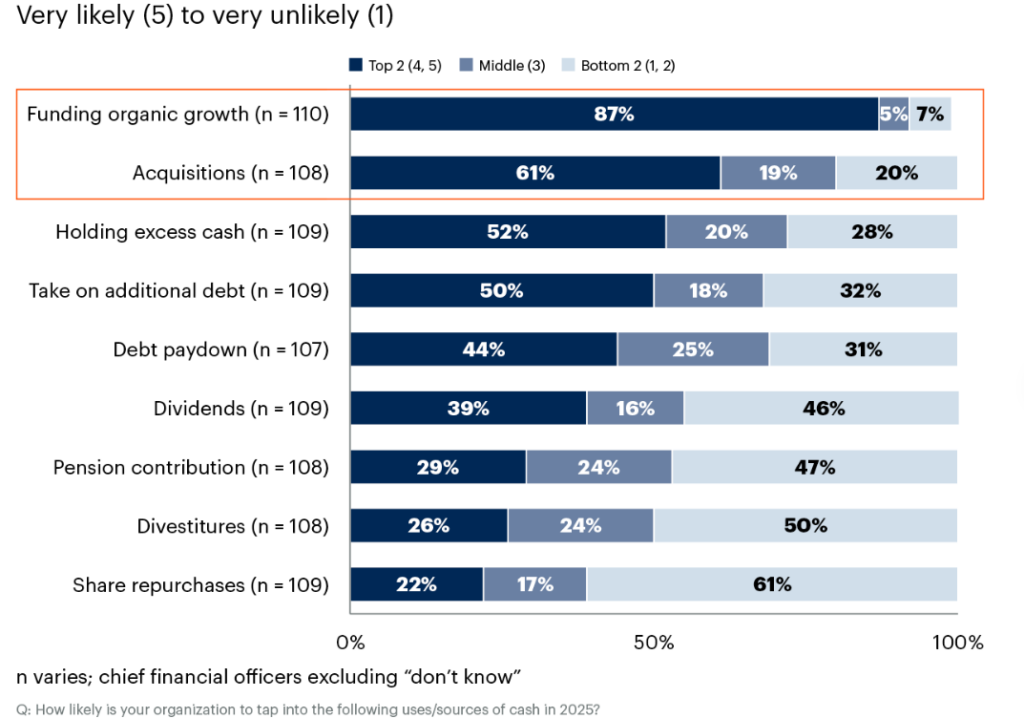

The survey, which polled 110 CFOs across a range of industries and regions in November 2024, found that 87% of CFOs are likely to allocate funds for organic growth next year.

Additionally, 61% of respondents indicated that acquisitions would also be a priority, while 52% said they would likely hold on to excess cash.

“The fragmentation of global policies is diminishing economies of scale, posing threats to organizations reliant on large-scale operations,” said Janel Everly, senior director analyst in the Gartner Finance practice.

“CFOs must seize current economic shifts to unlock transformative value for their organizations through strategic, well-timed, deals to employ capital agility, as well as bold investments to set them apart from competitors.”

Likelihood of Cash Use Cases

Everly also noted that while retaining surplus cash during volatile periods is a common financial strategy, the companies that successfully navigate economic uncertainty often take a different approach.

“Gartner research suggests that the select few organizations that successfully achieve efficient growth across various economic conditions usually allocate capital to growth during challenging times and reduce operating costs when experiencing strong growth,” she said.

As CFOs prepare for the challenges of 2025, the need for strategic capital allocation is clear.

While organic growth and acquisitions top the list of priorities, the broader economic landscape is also forcing CFOs to consider how to adapt to shifting regulatory environments and increasingly complex legal standards.

The report highlights that CFOs must not only focus on growth and acquisitions but also allocate significant resources to tackle a range of business challenges, including corporate tax issues, labor and employment concerns, supplier contracts, and trade compliance.

The rise of deglobalization and nationalism is reshaping global trade and legal standards, leading to more complex regulatory environments that could require companies to reassess their business models.

“CFOs should take immediate actions such as working with general counsel to establish legal documentation, assess competitors’ strategic readiness, and coordinate with the chief human resources officer to plan for workforce transitions,” Everly explained.

Everly also emphasized the importance of collaboration with other key business leaders, such as the head of enterprise risk management and the head of supply chain, to plan for potential disruptions and implement scenario planning.